The founder of FTX, Sam, gained tremendous wealth thx to arbitrage when he used to be a trader.

Arb's strategy is to make profits by taking advantage of the price gap created by various situations such as hacking and rapid market changes.

Typically, when pegging of ust was broken and things were very crowded, arb created a 'graduate' who made a huge profit from hundreds of millions to tens of billions of dollars.

However, in order to make profits with arb, understanding of each chain and bridge must be preceded to some extent, and it is better to sign up lots of cex exchanges in advance.

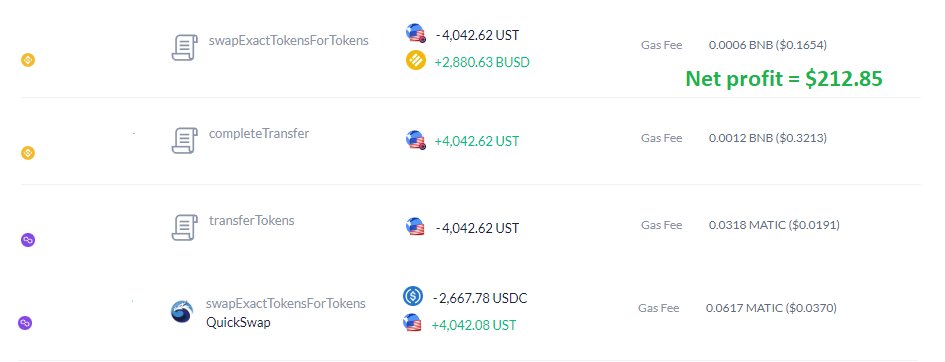

The deposit and withdrawal availability of each exchange can be problematic.

Arb profits can be earned through a gap between cross-chain, on same chain and centralized exchange and decentralized exchange.

Below is a case of twitter user who earned $15,000 in May alone through arb.

* https://dexscreener.com/ helps you to find it

2. Wait for the price gap to happen

4. The gap between the bsc and polygon chains widened and the value of 'sell/buy-1' was calculated to see if it was worth an arbitrage, and 30% was out.

$0.04324 / $0.03332 - 1 = 30%

a. Ensure that the price gap is wide enough

b. Ensure that the calculation is sufficient to make a profit

5. Now, it's the area of trading

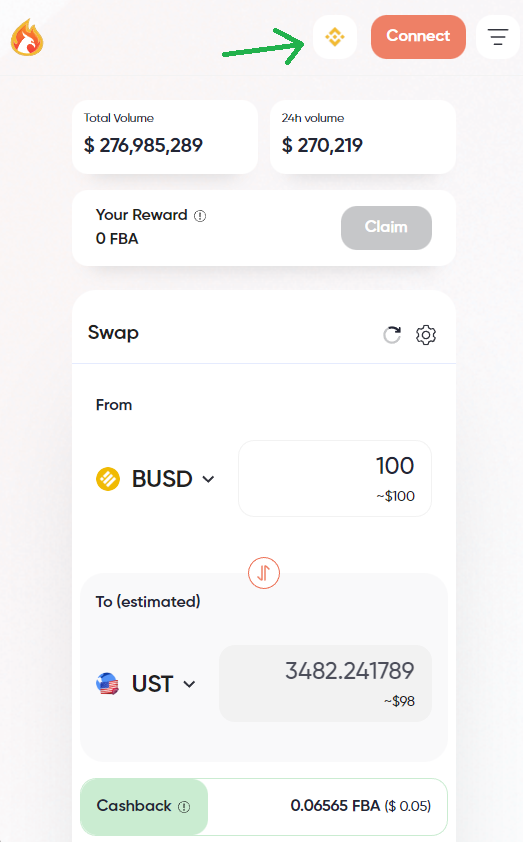

- buy ust on Firebird.Fianance

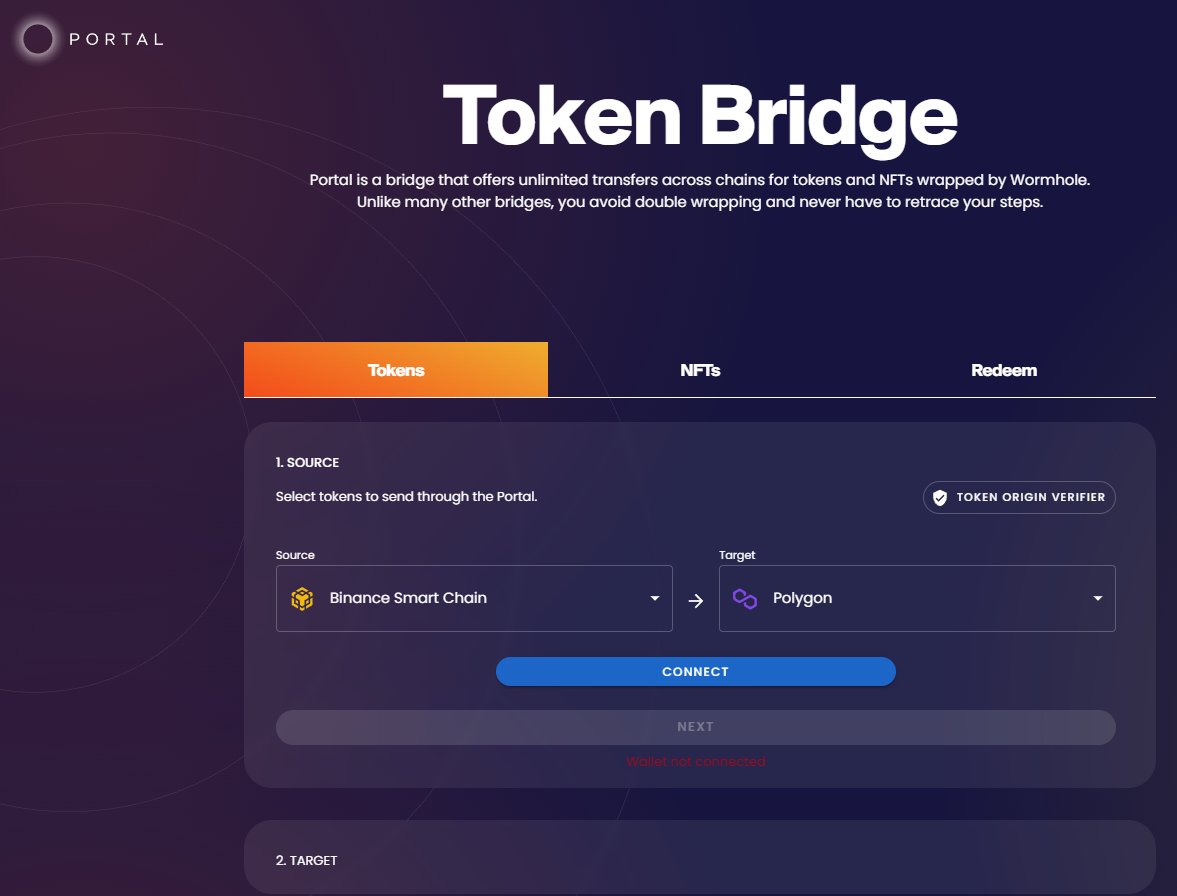

- The purchased ust is sent to the polygon chain through Portalbridge

- sell ust on Firebird.Fianance(polygon)

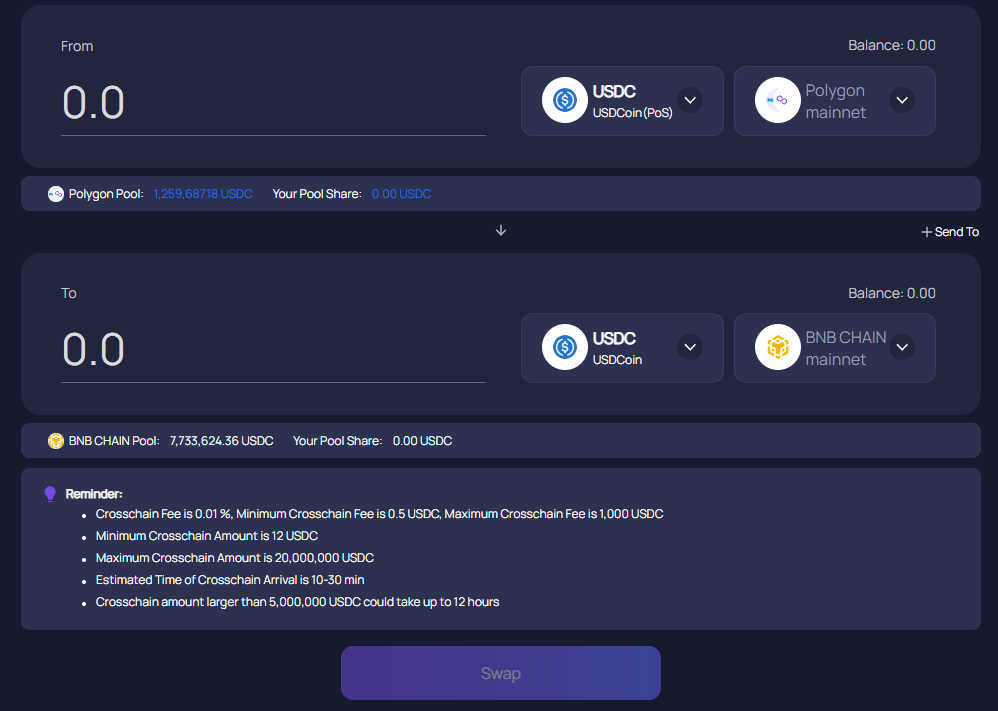

- usdc revenue from selling is sent back to bsc chain via Multichain

6. However, it is important to check how much the price gap is maintained, and to send a small amount to make sure that it is worth a try.

👀 The case of success and failure

💬 In addition to the dexscreener, you can check various prices of coins listed on various cex and dex through the Coinmarketcap and Coingecko (but I recommend checking with dexscreener), and since the deposit and withdrawal situation may be different for each exchange, it is better to sign up for many exchanges in advance.

👏 Cex exchanges you need to sign up in advance

Comments

Post a Comment